COLVIN + HALLETT BLOG

To Lie Is “Human Nature,” To Exclude Is Divine

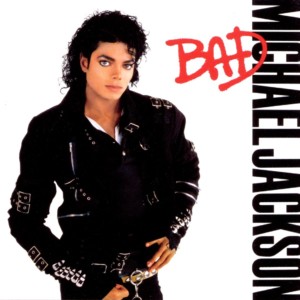

The IRS proposed estate tax deficiencies of hundreds of millions of dollars against the Estate of Michael Jackson, accusing the Estate of undervaluing the assets held by the King of Pop at his death. Much of the case has been settled, but the parties still dispute the value of the Gloved One’s image and likeness, with the IRS contending it was worth $161 million and the estate contending the value was far less. A trial on this issue (along with the value of certain music catalogues) was held in February of 2017.

The IRS proposed estate tax deficiencies of hundreds of millions of dollars against the Estate of Michael Jackson, accusing the Estate of undervaluing the assets held by the King of Pop at his death. Much of the case has been settled, but the parties still dispute the value of the Gloved One’s image and likeness, with the IRS contending it was worth $161 million and the estate contending the value was far less. A trial on this issue (along with the value of certain music catalogues) was held in February of 2017.

From a spectator’s perspective, the most interesting thing about the trial was that the government’s valuation expert, Weston Anson, lied on cross-examination, claiming to have never worked for the IRS before. Anson then doubled down and specifically denied that he had ever been engaged to prepare a report about the value of intangible property rights held by the Whitney Houston estate, despite having signed such a report less than two years earlier.

The government sought to strike or seal the testimony, arguing that the testimony constituted an improper disclosure of protected taxpayer information, but the Tax Court disagreed in an order dated April 28, 2017, ruling that the fact that Mr. Anson had prepared a report for the IRS with respect to the Whitney Houston estate was not protected information.

On March 31, 2017, the estate filed a motion to exclude Mr. Anson’s testimony in light of his perjury, which would essentially leave the government without any support for its valuation position. The government filed a response on May 15, 2017. Some courts have held that perjury by an expert – even when the expert is working for the US government – is grounds for excluding the entire expert report. Contreras v. Secretary of HHS, 121 Fed. Cl. 230 (2015); Alta Wind I Owner-Lessor C v. United States, 128 Fed. Cl. 702 (2016) (appeal pending). We look forward to seeing whether the Tax Court will adopt a “divine” remedy.

NEWS + ALERTS

Enter your email address to receive updates and alerts on important developments in tax law.