by John Colvin | Dec 27, 2018 | Tax Advice, IRS Audits and Appeals, IRS Audit, IRS Appeal, Tax Audit Help

On Thursday, December 20, 2018, the Tax Court released its opinion in Alternative Health Care Advocates et al v. Comm’r, 151 T.C. No. 13 (2018), a case involving the disallowance of deductions related to trafficking of marijuana mandated by Section 280E of the Internal Revenue Code. The Alternative Health Care Advocates opinion broke new ground by extending the scope of the deduction disallowance beyond the legal owner/seller of marijuana to an affiliated entity that participated in the marijuana sales.

by John Colvin | Jul 20, 2017 | IRS Collections, IRS Audits and Appeals, Penalty Abatements & Relief, IRS Audit, IRS Appeal, Tax Audit Help

In McNeill v. Commissioner, 148 T.C. No. 23 (June 19, 2017), the Tax Court held that taxpayer challenges to penalties imposed in the wake of a TEFRA partnership audit or litigation can be challenged in collection due process (CDP) proceedings. It was always clear that if a taxpayer had personal defenses to a penalty asserted at the partnership level, the taxpayer could pay the penalty (and any associated interest), file a claim for refund, and have his personal defenses considered by the IRS and the courts.

by John Colvin | Jun 14, 2017 | IRS Appeal, Tax Audit Help, IRS Audit, IRS Audits and Appeals, Tax Litigation

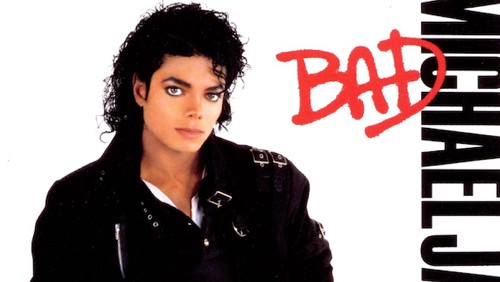

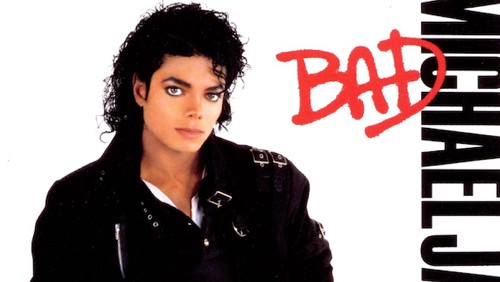

The IRS proposed estate tax deficiencies of hundreds of millions of dollars against the Estate of Michael Jackson, accusing the Estate of undervaluing the assets held by the King of Pop at his death. Much of the case has been settled, but the parties still dispute the value of the Gloved One’s image and likeness, with the IRS contending it was worth $161 million and the estate contending the value was far less. A trial on this issue (along with the value of certain music catalogues) was held in February of 2017.

by John Colvin | May 18, 2017 | Tax Litigation, Tax Advice

In November, 2016, the IRS served a John Doe summons on Coinbase, one of the largest institutions holding bitcoins for clients, seeking information about virtually all bitcoin transactions by U.S. customers over a multi-year period (2013-2015). Initially, aggrieved customers filed an action challenging the summons (perhaps fearing that Coinbase would not do so), but subsequently Coinbase intervened, and the U.S. sought to enforce the summons issued to Coinbase. The matter is currently pending in the Northern District of California. United States v. Coinbase, Inc., No. 3:17-cv-01431-JSC (N.D. Cal. March 16, 2017). Interestingly, in March of 2017, the IRS filed a declaration noting that only 1,000 individual returns from 2013 to 2015 reported gain or loss from the sale of bitcoin (while anecdotal evidence suggests that there were hundreds of thousands of transactions). The IRS considers bitcoin property, rather than a currency (IRS Notice 2014-21), and the failure of taxpayers to report transactions certainly suggests the potential for significant non-compliance. Although the decision is still pending, if the IRS prevails, there could be audits coming down the line.