by Colvin Hallett | Aug 23, 2017 | Criminal Tax Defense, Tax Litigation

Colvin + Hallett Law would like to thank our peers in the legal community for selecting our own John Colvin as the Best Lawyers© 2018 Lawyer of the Year: Seattle Litigation and Controversy – Tax, and for inclusion in the 24th Edition of The Best Lawyers in America© for his work in:

Criminal Defense: White-Collar

Litigation and Controversy: Tax

by Cory Johnson | Aug 9, 2017 | Tax Litigation, Tax Advice

On July 10, 2017, the U.S. District Court for the District of Columbia issued a permanent injunction prohibiting the IRS from charging a fee for the issuance and renewal of preparer tax identification numbers (PTINs), after concluding that the IRS lacked statutory authority to charge such user fees. Steele, et al. v. United States of America, No. 14-cv-1523 (D. D.C. June 1, June 10, 2017). The Court also ordered the IRS to refund all PTIN user and renewal fees paid since the inception of the PTIN program. In response to the Court’s order, the IRS suspended its collection of PTIN user fees and issued a statement indicating it is working with the Department of Justice to determine how to proceed regarding the Court’s order to refund past PTIN fees paid.

by John Colvin | Jun 14, 2017 | IRS Audit, IRS Appeal, Tax Audit Help, Tax Litigation, IRS Audits and Appeals

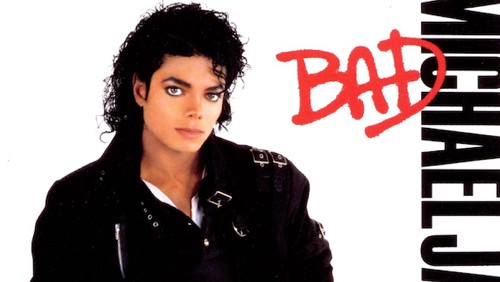

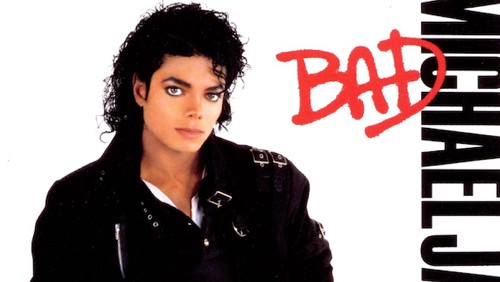

The IRS proposed estate tax deficiencies of hundreds of millions of dollars against the Estate of Michael Jackson, accusing the Estate of undervaluing the assets held by the King of Pop at his death. Much of the case has been settled, but the parties still dispute the value of the Gloved One’s image and likeness, with the IRS contending it was worth $161 million and the estate contending the value was far less. A trial on this issue (along with the value of certain music catalogues) was held in February of 2017.

by John Colvin | May 18, 2017 | Tax Litigation, Tax Advice

In November, 2016, the IRS served a John Doe summons on Coinbase, one of the largest institutions holding bitcoins for clients, seeking information about virtually all bitcoin transactions by U.S. customers over a multi-year period (2013-2015). Initially, aggrieved customers filed an action challenging the summons (perhaps fearing that Coinbase would not do so), but subsequently Coinbase intervened, and the U.S. sought to enforce the summons issued to Coinbase. The matter is currently pending in the Northern District of California. United States v. Coinbase, Inc., No. 3:17-cv-01431-JSC (N.D. Cal. March 16, 2017). Interestingly, in March of 2017, the IRS filed a declaration noting that only 1,000 individual returns from 2013 to 2015 reported gain or loss from the sale of bitcoin (while anecdotal evidence suggests that there were hundreds of thousands of transactions). The IRS considers bitcoin property, rather than a currency (IRS Notice 2014-21), and the failure of taxpayers to report transactions certainly suggests the potential for significant non-compliance. Although the decision is still pending, if the IRS prevails, there could be audits coming down the line.