by John Colvin | Dec 27, 2018 | Tax Audit Help, IRS Appeal, IRS Audit, IRS Audits and Appeals, Tax Advice

On Thursday, December 20, 2018, the Tax Court released its opinion in Alternative Health Care Advocates et al v. Comm’r, 151 T.C. No. 13 (2018), a case involving the disallowance of deductions related to trafficking of marijuana mandated by Section 280E of the Internal Revenue Code. The Alternative Health Care Advocates opinion broke new ground by extending the scope of the deduction disallowance beyond the legal owner/seller of marijuana to an affiliated entity that participated in the marijuana sales.

by John Colvin | Jul 20, 2017 | IRS Collections, IRS Audits and Appeals, Tax Audit Help, IRS Appeal, IRS Audit, Penalty Abatements & Relief

In McNeill v. Commissioner, 148 T.C. No. 23 (June 19, 2017), the Tax Court held that taxpayer challenges to penalties imposed in the wake of a TEFRA partnership audit or litigation can be challenged in collection due process (CDP) proceedings. It was always clear that if a taxpayer had personal defenses to a penalty asserted at the partnership level, the taxpayer could pay the penalty (and any associated interest), file a claim for refund, and have his personal defenses considered by the IRS and the courts.

by Cory Johnson and Sam North | Jun 28, 2017 | Tax Audit Help, IRS Appeal, IRS Audit, IRS Audits and Appeals

On May 23, 2017, IRS Officials announced in an industry webcast that the IRS began a campaign to identify foreign companies that should be filing Form 1120-F, but have not. The officials also warned that the IRS intends to follow up on every potential non-compliant company it identifies and refer some for further audit. Apparently initial letters have just been sent to companies or will be coming “very, very soon.”

by Cory Johnson | Jun 21, 2017 | Tax Audit Help, IRS Appeal, IRS Audit, IRS Audits and Appeals

In January, the IRS announced a rollout of its compliance campaigns targeting certain issues on which the IRS Large Business & International (LB&I) will focus its examinations. It is part of LB&I’s shift to issue-focused examinations in light of a diminished IRS budget. Since the announcement, LB&I has been conducting a series of webinars on its 13 new campaigns. On June 6, LB&I executives provided information on its Related-Party Transactions (RPT) campaign, which is one of the 13 campaigns.

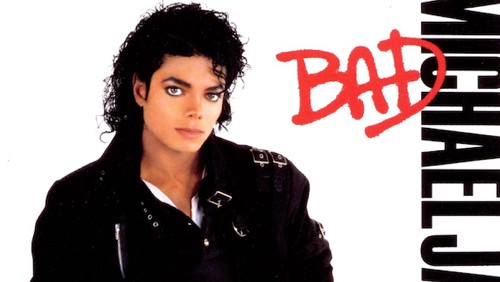

by John Colvin | Jun 14, 2017 | Tax Litigation, IRS Audits and Appeals, Tax Audit Help, IRS Appeal, IRS Audit

The IRS proposed estate tax deficiencies of hundreds of millions of dollars against the Estate of Michael Jackson, accusing the Estate of undervaluing the assets held by the King of Pop at his death. Much of the case has been settled, but the parties still dispute the value of the Gloved One’s image and likeness, with the IRS contending it was worth $161 million and the estate contending the value was far less. A trial on this issue (along with the value of certain music catalogues) was held in February of 2017.

by Cory Johnson | May 31, 2017 | IRS Audit, Tax Audit Help, IRS Appeal, International Compliance, IRS Audits and Appeals

The IRS is distancing itself from the advice it offers to taxpayers on its OWN website. The IRS announced on May 18th in Memorandum SBSE-04-0517-0030, that “FAQs that appear on IRS.gov but that have not been published in the Internal Revenue Bulletin (IRB) are not legal authority and should not be used to sustain a position.” Essentially the IRS has told its examiners that if a taxpayer relies on an FAQ on the IRS’s website, the examiner need not follow that authority and can find against the taxpayer unless the advice in the FAQ have been published in something that is “legal authority.” Many taxpayers might find it surprising that they can’t rely on what the IRS posts on its own website. We certainly did. Accordingly, before any taxpayer relies on the IRS website, the taxpayer should be sure there is other “legal authority.”