by Cory Johnson | May 31, 2017 | Tax Audit Help, IRS Appeal, IRS Audit, International Compliance, IRS Audits and Appeals

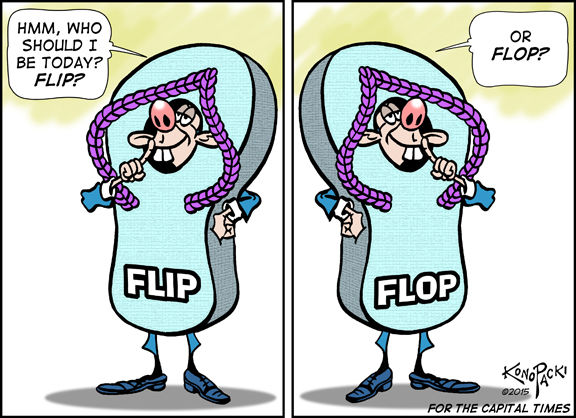

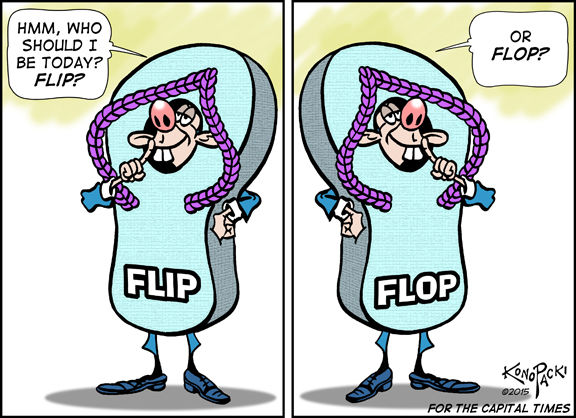

The IRS is distancing itself from the advice it offers to taxpayers on its OWN website. The IRS announced on May 18th in Memorandum SBSE-04-0517-0030, that “FAQs that appear on IRS.gov but that have not been published in the Internal Revenue Bulletin (IRB) are not legal authority and should not be used to sustain a position.” Essentially the IRS has told its examiners that if a taxpayer relies on an FAQ on the IRS’s website, the examiner need not follow that authority and can find against the taxpayer unless the advice in the FAQ have been published in something that is “legal authority.” Many taxpayers might find it surprising that they can’t rely on what the IRS posts on its own website. We certainly did. Accordingly, before any taxpayer relies on the IRS website, the taxpayer should be sure there is other “legal authority.”

by Cory Johnson | May 18, 2017 | Employment Tax Audits, Tax Audit Help, IRS Appeal, IRS Audit, IRS Audits and Appeals, Criminal Tax Defense, IRS Collections, Trust Fund

On March 21, 2017, the Treasury Inspector General for Tax Administration (TIGTA) issued a report titled, “A More Focused Strategy Is Needed to Effectively Address Egregious Employment Tax Crimes.” The Report noted that, as of December, 2015, 1.4 million employers owed approximately $45.6 billion in unpaid employment taxes, interest, and penalties. The report indicated that in 2015, the IRS assessed the TFRP against 38% fewer responsible persons than just five years before (asserting the TFRP against just 11% of responsible individuals), and that simultaneously the number of employers with egregious employment tax noncompliance (20 or more quarters of delinquent employment taxes) has tripled in a 17-year period. TIGTA was concerned that, despite this noncompliance, there are fewer than 100 criminal convictions for employment tax violations per year.